About Us

Solutions

Capital structure determines how your business is funded—and how risky it appears to investors.

Capital structure determines how your business is funded—and how risky it appears to investors.

Capital structure represents the financial foundation upon which every business stands—the strategic mix of debt and equity that determines how a company funds its operations, growth initiatives, and long-term ambitions.

This fundamental financing decision shapes everything from daily cash flow management to major acquisition opportunities, often determining whether companies thrive during expansion phases or struggle under the weight of poorly structured obligations.

Most business leaders treat capital structure as an afterthought, cobbling together financing as opportunities arise rather than architecting a strategic framework.

This reactive approach can create unnecessary constraints during critical growth phases, limit access to favorable financing terms, and send conflicting signals to investors who scrutinize these decisions as indicators of management sophistication.

The difference between thoughtful capital structure planning and opportunistic deal-making often separates companies that scale efficiently from those that hit funding walls at the worst possible moments.

Capital structure functions as the blueprint for how companies finance their existence and growth—a deliberate combination of debt financing and equity funding that reflects management's strategic priorities, risk tolerance, and market positioning.

Rather than simply representing where money comes from, capital structure communicates powerful signals about leadership confidence, business model sustainability, and long-term value creation philosophy.

This financing framework encompasses every dollar invested in the business, from initial founder contributions and angel investments to bank loans, venture debt, and public market offerings.

The proportional mix between borrowed capital and ownership stakes creates a unique financial fingerprint that influences everything from daily operations to strategic transactions.

Here's what separates successful executives from the rest: they understand that capital structure isn't just about accessing money—it's about optimizing the cost and flexibility of that capital to accelerate value creation.

When investors evaluate companies, they're not just looking at current performance metrics; they're assessing whether the capital structure supports sustainable growth or creates potential headwinds that could derail future opportunities.

Capital structure consists of two fundamental building blocks, each offering distinct advantages and creating specific obligations that influence business strategy and operational flexibility:

Debt Financing encompasses all borrowed capital that companies must repay according to predetermined terms, regardless of business performance. This category includes:

Debt typically offers a lower cost of capital compared to equity, provides tax deductibility benefits through interest expense, and allows existing shareholders to maintain ownership control without dilution.

However, debt creates fixed payment obligations that must be met even during challenging periods, introduces financial covenants that can restrict operational flexibility, and increases financial risk through leverage that amplifies both positive and negative business outcomes.

Equity Financing represents ownership stakes in the company, including:

Equity provides permanent capital with no mandatory repayment requirements, offers operational flexibility during difficult periods, and aligns investor interests with long-term value creation rather than short-term payment obligations.

The trade-offs include a higher cost of capital compared to debt, ownership dilution that reduces existing shareholders' control and economic returns, and potential conflicts between different shareholder classes with varying risk tolerances and return expectations.

Most growing companies struggle with the timing and sequencing of these financing sources rather than understanding the individual components.

The challenge isn't choosing between debt and equity in isolation—it's orchestrating a capital structure evolution that matches business lifecycle stages, market conditions, and strategic objectives.

This requires sophisticated judgment about when leverage accelerates returns versus when it constrains flexibility, and how ownership dilution today impacts long-term value capture for founders and early investors.

Understanding capital structure becomes clearer through real-world examples that illustrate how different approaches align with business models, growth stages, and strategic priorities:

A SaaS company funded entirely through founder savings, early customer revenues, and reinvested profits maintains complete ownership control and operational flexibility.

This structure eliminates debt service obligations during unpredictable early growth phases but may limit scaling velocity compared to companies with external capital.

The trade-off involves slower initial growth in exchange for maintaining maximum ownership and avoiding the complexity of investor management.

A mature industrial business acquired through a leveraged buyout employs high debt levels to amplify equity returns while benefiting from predictable cash flows that support debt service.

This aggressive structure maximizes returns for equity investors but creates operational constraints through financial covenants and requires disciplined cash flow management to maintain debt coverage ratios.

An established tech company balances moderate leverage to optimize WACC while maintaining financial flexibility for acquisitions and R&D investments.

This blended approach provides cost-effective capital access through public debt markets while preserving capacity for opportunistic growth investments that require rapid capital deployment.

Optimal capital structure isn't about copying successful companies—it's about aligning financing choices with your specific business model, cash flow characteristics, and growth trajectory.

A subscription business with predictable recurring revenue can support higher leverage than a project-based consulting firm with lumpy cash flows. Understanding these nuances prevents costly mismatches between financing structure and operational reality.

Capital structure decisions create ripple effects throughout every aspect of business operations and strategic planning, influencing everything from daily cash management to major expansion opportunities in ways that many executives underestimate.

The mix between debt and equity directly determines your weighted average cost of capital (WACC), which serves as the benchmark for evaluating all investment decisions. Companies with optimal capital structures can pursue growth opportunities that would be economically unfeasible for businesses with higher capital costs, creating competitive advantages that compound over time.

Capital structure choices determine how quickly companies can respond to market opportunities or navigate challenging periods. Businesses with conservative leverage maintain capacity for opportunistic investments or acquisitions, while highly leveraged companies may struggle to access additional capital during critical growth phases or economic downturns. Strategic capital allocation becomes critical for maintaining this flexibility.

Sophisticated investors and lenders evaluate capital structure as a proxy for management competence and business model sustainability.

Well-structured companies command premium valuations and favorable financing terms, while poorly capitalized businesses face increased scrutiny and higher capital costs that can become self-reinforcing constraints.

Capital structure influences day-to-day business decisions through debt covenants, cash flow requirements, and investor expectations.

Companies with restrictive debt agreements may find themselves unable to pursue strategic initiatives or make necessary investments, while businesses with patient equity capital can focus on long-term value creation rather than short-term financial metrics.

This is where having experienced financial leadership becomes invaluable—understanding how capital structure decisions made today will impact strategic options five years from now.

Most business leaders focus on immediate capital needs without considering how current financing choices will constrain or enable future opportunities.

The ability to think systematically about capital structure evolution separates companies that maintain strategic flexibility from those that paint themselves into financial corners.

The relationship between capital structure and weighted average cost of capital represents one of the most critical concepts in corporate finance, directly influencing every investment decision and strategic initiative a company undertakes.

WACC calculates the blended cost of all capital sources, weighted by their proportional contribution to total capitalization.

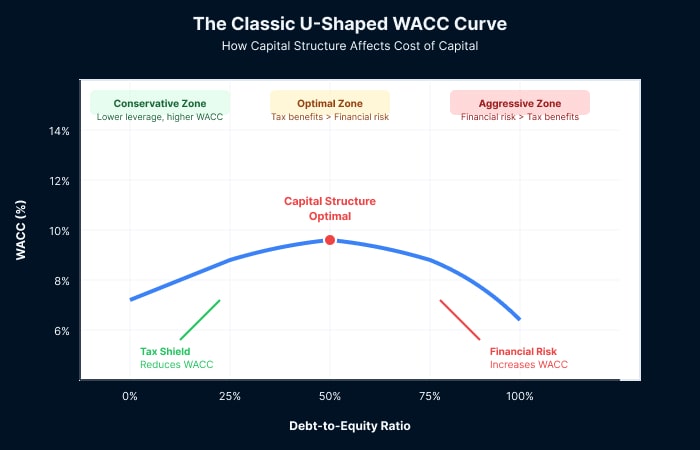

As companies increase debt levels, they initially benefit from lower-cost debt financing and tax deductibility of interest expenses, reducing overall WACC and creating value for shareholders through what finance professionals call the "tax shield effect."

However, this relationship isn't linear or infinite.

As leverage increases beyond optimal levels, the rising cost of debt—driven by increased default risk and restrictive covenants—eventually outweighs the tax benefits, causing WACC to increase and destroying shareholder value.

This creates the classic U-shaped WACC curve that theoretical finance literature describes, but real-world implementation makes this considerably more complex.

The challenge most companies face?

Identifying their optimal capital structure isn't an academic exercise with clean mathematical solutions.

Industry dynamics, business model characteristics, cash flow predictability, and market conditions all influence where the optimal leverage point exists for any given company.

A predictable subscription business might optimize at 60% debt, while a cyclical manufacturing company might target 30% debt to maintain flexibility during downturns.

Changes in capital structure create immediate impacts on WACC that flow through to project evaluation, acquisition analysis, and strategic planning decisions.

When companies successfully optimize their capital structure, they can pursue growth opportunities that were previously uneconomical, creating competitive advantages that compound over time through superior capital allocation.

WACC optimization requires ongoing attention rather than one-time analysis.

Business model evolution, market condition changes, and growth phase transitions all shift the optimal capital structure target, requiring continuous recalibration to maintain competitive advantage through efficient capital deployment.

Optimizing capital structure requires systematic analysis that balances multiple competing objectives while considering company-specific factors, industry dynamics, and market conditions that influence financing costs and availability.

Begin by evaluating the current cost of debt versus cost of equity, considering both explicit costs (interest rates, dividend requirements) and implicit costs (covenants, dilution, control restrictions).

This analysis should incorporate tax benefits from debt financing while recognizing that these advantages diminish as financial risk increases with higher leverage levels.

The key insight most companies miss? The cheapest capital today isn't always the smartest capital for tomorrow's growth plans.

Compare capital structure ratios against relevant industry peers and competitors, recognizing that optimal structures vary significantly across business models and market segments.

Technology companies typically operate with lower leverage than utilities or real estate firms due to different cash flow characteristics and asset bases that support debt financing.

Don't fall into the trap of copying your competitors' capital structures without understanding the underlying business model differences.

A SaaS company with predictable recurring revenue can support different leverage levels than a project-based consulting firm, even within the same technology sector.

Align capital structure with company development stage, from early-stage startups requiring flexible equity capital through mature businesses that can support predictable debt service obligations. Growth companies often need to evolve their capital structure as business models mature and cash flows become more predictable.

Monitor key ratios, including debt-to-equity, interest coverage, and return on invested capital (ROIC) to ensure capital structure supports both current operations and future growth opportunities.

These metrics should be evaluated against industry benchmarks and covenant requirements that may restrict operational flexibility.

These ratios tell a story about your company's financial health that investors read like a book.

Model capital structure performance under various business scenarios, including growth acceleration, market downturns, and competitive pressures that could impact cash flow generation and debt service capacity.

This analysis helps identify optimal structures that provide adequate flexibility across different operating environments.

The expertise gap becomes evident when companies attempt capital structure optimization without understanding the interconnected nature of financing decisions, business strategy, and market dynamics.

Working capital management, cash flow forecasting, and strategic planning all influence optimal capital structure, requiring sophisticated financial analysis that many growing companies lack internally. This is precisely when fractional or interim CFO expertise can transform capital structure from a reactive funding exercise into a strategic value creation tool.

Different capital structure approaches reflect varying philosophies about risk, growth, and value creation, each offering distinct advantages that align with specific business contexts and strategic objectives.

Companies employing conservative capital structures typically maintain debt levels below 30% of total capitalization, prioritizing financial flexibility and operational stability over cost optimization.

Highly leveraged companies often maintain debt levels above 60% of total capitalization, maximizing tax benefits while amplifying equity returns through financial leverage.

Many successful companies adopt balanced approaches with debt levels between 30-50% of total capitalization, optimizing cost of capital while maintaining strategic flexibility for growth investments and market opportunities.

Successful companies evolve their approach based on business lifecycle, market conditions, and competitive dynamics rather than maintaining static structures.

A technology startup might begin with conservative equity financing, transition to balanced leverage as revenues stabilize, and potentially employ more aggressive structures during mature phases with predictable cash generation.

Understanding this evolution prevents companies from locking into suboptimal structures that constrain long-term value creation.

Most companies begin their capital structure journey with whatever funding they can access—founder savings, friends and family money, or early angel investments.

This reactive approach serves survival needs but rarely reflects strategic thinking about optimal financing mix.

As businesses grow and capital needs become more sophisticated, the gap between ad-hoc financing and strategic capital structure planning becomes a competitive liability.

The transformation from reactive financing to strategic capital structure requires insider knowledge that most growing companies don't possess internally.

Understanding how market conditions influence debt pricing, when equity dilution makes strategic sense, how covenant structures impact operational flexibility, and which capital structure signals resonate with different investor types—this expertise typically comes from years of experience across multiple companies, industries, and market cycles.

The complexity compounds during critical growth phases, fundraising processes, or strategic transactions where capital structure decisions have lasting implications.

Many companies discover this expertise requirement at precisely the wrong moment—during fundraising, acquisition discussions, or market downturns when capital structure decisions carry outsized consequences.

Forward-thinking organizations often explore different approaches to bridge this gap. Some establish ongoing relationships with virtual CFO expertise for strategic support during complex capital planning cycles. They are there when and where you need the strategic guidance the most - without the added cost of an office commute and with the added benefit of selecting from a larger talent pool.

Others find value in bringing experienced executives into temporary leadership roles, particularly when interim guidance can guide the organization through pivotal transitions or restructuring initiatives.

Still others focus on developing internal capabilities, investing in finance team development to build the sophisticated thinking that capital structure optimization demands.

McCracken Alliance helps connect talent with companies looking for experienced financial leadership that understands both the art and science of capital structure optimization.

We recognize the challenges growing companies face in making capital structure decisions that will either accelerate or constrain their growth for years to come.

If you want, we'd love it if you would reach out today for a 30-minute, no strings complimentary Capital Structure Consultation to discover how strategic capital structure planning could transform your financing approach.

Your next funding decision could define your future—make it count!

Capital structure is how a company chooses to fund its operations and growth—essentially the mix of borrowed money (debt) and ownership stakes (equity) that provides the capital needed to run the business. Think of it as the financial foundation that determines both the cost and flexibility of funding.

Capital structure directly impacts your weighted average cost of capital by changing the proportion of expensive equity versus cheaper debt financing. Generally, moderate increases in debt reduce WACC through tax benefits and lower-cost financing, but excessive leverage increases financial risk and drives WACC higher.

Optimal capital structure minimizes your company's cost of capital while maintaining adequate financial flexibility for growth and unexpected challenges. This varies significantly by industry, business model, and lifecycle stage—there's no universal "right" answer, only what works best for your specific situation.