About Us

Solutions

Compare S Corps vs LLCs to find the best fit for your business. Learn about tax savings, liability protection, setup costs and more.

Compare S Corps vs LLCs to find the best fit for your business. Learn about tax savings, liability protection, setup costs and more.

Picture this: You're building the next great business empire (or at least a respectable small business), and suddenly everyone's asking about your "business structure."

One person swears by LLCs, another insists S Corps are the way to go, and your accountant just sent you a cryptic email about "tax elections" that might as well be written in hieroglyphics.

Here's the truth:

Choosing between an LLC and S Corp isn't about picking the "best" option—it's about finding the right fit for your specific situation, growth trajectory, and tolerance for paperwork.

Both structures offer solid liability protection and pass-through taxation, but they diverge significantly in their operational requirements, tax implications, and strategic flexibility.

This comparison cuts through the jargon to help founders, entrepreneurs, and growing businesses make an informed decision based on real-world implications rather than generic advice.

A Limited Liability Company (LLC) represents the Swiss Army knife of business entities—versatile, straightforward, and designed for maximum operational flexibility.

LLCs protect personal assets from business liabilities while maintaining minimal administrative overhead.

The structure accommodates everything from solo consulting practices to multi-member partnerships with complex profit-sharing arrangements.

LLCs operate under state law with broad discretion in :

Members can be :

This flexibility extends to taxation, where LLCs can choose their tax classification or accept the default pass-through treatment.

Here's where many business owners get confused: "S Corp" isn't actually a type of business entity.

It's a tax election available to eligible LLCs and corporations. When an LLC elects S Corp taxation (using Form 2553), it keeps its underlying LLC structure but adopts S Corporation tax treatment.

This distinction matters because an "S Corp election" transforms how the IRS treats your business income without changing your fundamental business structure, liability protections, or state-level operations.

The S Corp election primarily affects federal tax obligations, payroll requirements, and income characterization.

Let's be honest here—this confusion trips up even experienced business owners.

The IRS didn't exactly win any awards for clarity when it decided to call a tax election by the same name as an actual business entity type. But once you grasp this concept, everything else falls into place much more logically.

LLCs accommodate unlimited members with no restrictions on citizenship, residency, or entity type. Foreign investors, corporations, partnerships, trusts, and other LLCs can all hold membership interests.

Members can contribute cash, property, or services in exchange for ownership interests, and profit distributions need not align with ownership percentages.

S Corp elections come with strict eligibility requirements that eliminate many businesses from consideration:

These restrictions reflect the S Corp's original purpose: providing small, closely-held businesses with pass-through taxation benefits while maintaining traditional corporate governance structures.

LLC members report their share of business income, deductions, and credits on personal tax returns regardless of whether they actually received cash distributions. This pass-through taxation eliminates double taxation but creates potential cash flow challenges when profits remain in the business for growth or working capital needs.

LLC members generally pay self-employment tax on their entire share of business income, currently 15.3% on the first $168,600 of earnings (2024 figures). This represents the combined employer and employee portions of Social Security and Medicare taxes.

However, LLCs enjoy considerable flexibility in tax elections. They can choose corporate taxation, S Corp taxation, or partnership taxation, depending on their specific circumstances and growth plans.

S Corp taxation introduces a critical distinction between salary and distributions that can generate significant tax savings for profitable businesses.

The mechanics work because S Corp owner-employees wear two hats: they're employees who must receive W-2 wages at market rates, and they're also owners who can receive profit distributions.

The IRS requires the salary portion to reflect fair compensation for services rendered, but profits beyond that reasonable salary can flow through without the 15.3% self-employment tax burden that LLC members face on their entire share of business income.

Owner-employees must receive "reasonable compensation" subject to payroll taxes, but additional profits can be distributed without self-employment tax obligations.

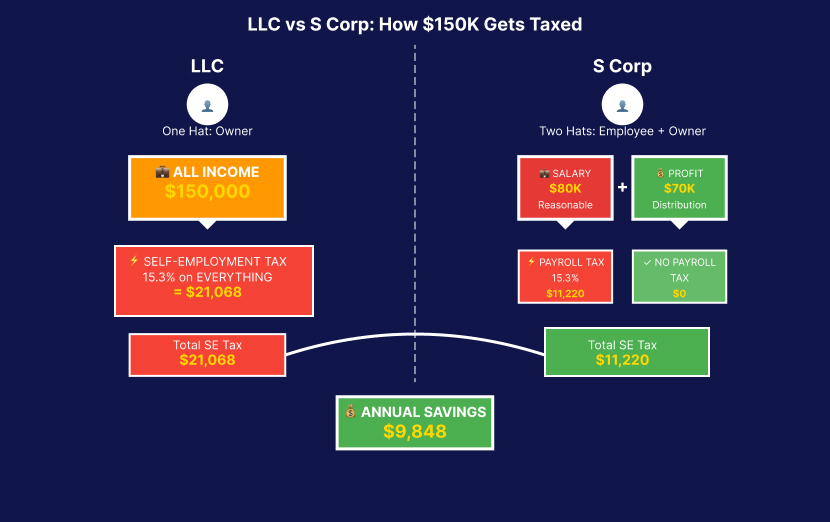

Consider a consulting business generating $150,000 in annual profit:

The S Corp election saved nearly $10,000 annually in this example, though these savings come with additional administrative costs and compliance requirements.

You know what nobody tells you about S Corp elections?

The IRS doesn't publish a handbook titled "What Constitutes Reasonable Compensation for Your Industry."

Business owners often spend considerable time researching comparable salaries and documenting their rationale—because the IRS will definitely ask questions if your salary looks suspiciously low compared to your distributions.

LLC compliance requirements remain relatively minimal across most states.

Annual reports, typically ranging from $50-300, represent the primary ongoing obligation. Some states require publication notices for new LLCs, but day-to-day operations proceed without significant administrative overhead.

LLCs aren't required to maintain corporate formalities like annual meetings, board resolutions, or detailed minute books. While maintaining separation between business and personal affairs remains crucial for liability protection, the documentation requirements stay manageable.

S Corp elections transform simple businesses into compliance-heavy operations requiring:

These requirements don't just create busywork—they represent real costs in terms of accounting fees, payroll processing, and administrative time.

Many S Corp elections that make sense from a pure tax perspective become questionable when factoring in the total cost of compliance.

Let's talk reality for a moment.

If you're a solopreneur who can barely remember to file quarterly estimated taxes on time, jumping into an S Corp election might feel like volunteering for administrative waterboarding. The tax savings are real, but so are the penalties for missing payroll deposits or filing deadlines.

Both LLCs and S Corp elections provide identical liability protection for business owners' personal assets. The choice between LLC structure and S Corp taxation doesn't impact your legal protection from business debts, lawsuits, or other liabilities.

This protection operates through the legal principle of "separate entity" status. When properly maintained, creditors cannot pursue personal assets to satisfy business obligations, and business assets remain protected from personal creditor claims.

Liability protection requires consistent adherence to business formalities and clear separation between business and personal affairs. While LLCs face fewer formal requirements, both structures demand:

The S Corp election doesn't strengthen or weaken these protections—it simply changes how the IRS treats your income for tax purposes.

LLCs excel in situations requiring operational flexibility, diverse ownership structures, or minimal administrative overhead. They're particularly well-suited for:

S Corp elections deliver the most value for established businesses with consistent profitability and owners willing to embrace additional administrative requirements. The ideal candidates typically include:

Smart business structure selection starts with an honest assessment of your current situation and realistic projections about future growth. Consider these critical questions:

Businesses planning to hire employees eventually need payroll systems regardless of the structure choice. This reduces the administrative burden differential between LLCs and S Corp elections, making the tax savings more attractive.

S Corp elections work best for businesses with predictable income that can support regular salary payments. Seasonal businesses or those with highly variable income may struggle with the reasonable compensation requirements.

Running payroll isn't just about cutting paychecks—it involves quarterly tax deposits, annual filings, and ongoing compliance monitoring. Many business owners underestimate the administrative burden until they're living with it daily.

Businesses planning complex ownership structures, profit-sharing arrangements, or international expansion should carefully evaluate whether S Corp restrictions limit their strategic options.

Most tax professionals suggest considering S Corp elections when business profits consistently exceed $60,000-80,000 annually. Below this threshold, the administrative costs and compliance burden often outweigh the tax savings.

However, this threshold varies significantly based on industry, location, and individual circumstances. A consulting practice with minimal overhead might benefit from S Corp election at lower profit levels than a capital-intensive manufacturing business.

Sarah's Freelance Graphic Design Business:

Recommendation: LLC

The administrative burden of an S Corp election outweighs potential tax savings at this income level. Sarah benefits from LLC flexibility while maintaining liability protection for client work.

Mike's Management Consulting Firm:

Recommendation: S Corp Election

Mike's consistent profitability and growth plans make S Corp election attractive. Annual tax savings of $12,000-15,000 justify the additional administrative costs.

Alex's Software Development Company:

Recommendation: Start as LLC, Consider C Corp Conversion Later

S Corp restrictions on ownership and stock classes conflict with typical startup funding and growth strategies. LLCs provide initial flexibility with conversion options as the business matures.

Here's where business owners often get tripped up: they assume their current structure choice is permanent. The reality? Most successful businesses evolve their structure as they grow. Starting simple and upgrading later often beats over-engineering from day one.

LLCs can elect S Corp taxation at any time by filing Form 2553, though the effective date depends on timing. Elections filed by March 15th apply to the current tax year; later elections typically take effect the following year.

The transition process involves:

Smart business owners regularly evaluate whether their current structure still serves their needs. Consider reviewing your choice when:

Structure changes involve both one-time conversion costs and ongoing operational changes. Budget for legal fees, accounting adjustments, and potential tax implications when planning transitions.

Additionally, it is best as a growing company to bring on an interim CFO if you need experienced guidance through complex structure transitions and ongoing financial strategy—this would need to be determined based on your specific growth trajectory, compliance requirements, and internal financial capabilities.

Choosing between LLC structure and S Corp election isn't about finding a universally "correct" answer—it's about aligning your business structure with your specific circumstances, growth plans, and operational preferences.

LLCs provide maximum flexibility with minimal administrative overhead, making them ideal for early-stage businesses, complex ownership structures, or situations where operational simplicity outweighs tax optimization.

S Corp elections can deliver significant tax savings for profitable businesses with consistent income, but these benefits come with increased compliance requirements and operational restrictions.

The decision ultimately depends on your willingness to trade administrative complexity for potential tax savings, balanced against your specific business circumstances and growth trajectory.

Still not sure if an LLC or S Corp election is right for your business?

The choice impacts everything from daily operations to long-term growth strategies.

McCracken Alliance helps organizations navigate these decisions with practical insights based on real-world experience across dozens of industries and business models. We've seen firsthand what works (and what doesn't) when it comes to business structure selection and timing.

Our fractional and interim CFO services include comprehensive business structure analysis, tax planning strategies, and ongoing guidance as your business evolves. Sometimes the right answer isn't obvious until you've worked through the numbers with someone who's helped other businesses make these decisions successfully.

Schedule a consultation to discuss your specific situation and explore structure options that align with your business goals.

An LLC is a business structure that provides liability protection and operational flexibility. An S Corp is a tax election that eligible LLCs or corporations can make to potentially reduce self-employment taxes while maintaining pass-through taxation benefits.

S Corp elections may reduce self-employment taxes by allowing business owners to split income between salary (subject to payroll taxes) and distributions (not subject to self-employment tax). However, the tax benefits must justify the additional administrative costs and compliance requirements.

Yes. LLCs can elect S Corp taxation by filing Form 2553 with the IRS, provided they meet eligibility requirements including having 100 or fewer shareholders who are all U.S. citizens or residents.

Yes. S Corp elections require payroll administration, additional tax filings (Form 1120-S), reasonable compensation documentation, and various corporate formalities. LLCs typically require only annual state reports.

It depends on your specific situation. LLCs offer simplicity and flexibility for early-stage businesses. S Corp elections become more attractive for established businesses with consistent profits exceeding $60,000-80,000 annually, where tax savings justify the additional administrative burden.